-

Mission

Fipar-Holding is a subsidiary of CDG Invest, the investment arm of the CDG Group. Acquired by CDG in September 2003, Fipar-Holding has become a long-term investment fund, acting as an investor and minority shareholder in major companies and projects in Morocco. In 2019, as part of the implementation of the CDG Group's new strategy, Fipar-Holding was acquired by CDG Invest, and its strategy was readjusted to investing in sectors with low cyclicality, recurring returns and a controlled risk profile.

Today, Fipar-Holding constitutes a benchmark investor, with significant holdings in the infrastructure, industry and services sectors.

The role of Fipar-Holding is to actively accompany Moroccan private and public groups in their efforts to become leading references in Morocco and internationally. It also helps international groups set up and/or expand successfully in Morocco and the region, thanks to its in-depth knowledge of the market and local partners, its network of contacts and its proven experience in structuring and financing.

Fipar-Holding has made the choice to assist sustainably its partner companies, via a dynamic, pragmatic and constructive approach.

-

Mission

Nama Holding is a strategic investment fund dedicated to investment in industries having high export content/potential, replacing imports or responding to a logic of industrial sovereignty. It places a particular focus on Morocco's global business lines (automotive, textiles, agro-industry and aeronautics).

Structured in 2020 with a target size of MAD 1.5 billion expandable to MAD 3 billion in the medium term, Nama Holding aims to support Moroccan or foreign players with ambitious and profitable development projects in Morocco, that align with its strategic positioning, show high prospects for growth, and generate an additional economic impact on the targeted sector and/or industry.

-

Mission

CDG Invest Management is a collective investment fund management company. It manages thematic funds. currently manages the InfraMaroc fund, focused on infrastructure investments, as well as the Morocco Global Business Lines Fund.

-

Mission

CDG Invest Growth is a fund management company that makes development capital investments in Moroccan and African companies with strong potential. The aim is to provide them with capital for their growth as well with expertise and counselling to help them become leading references in Morocco and internationally.

-

Mission

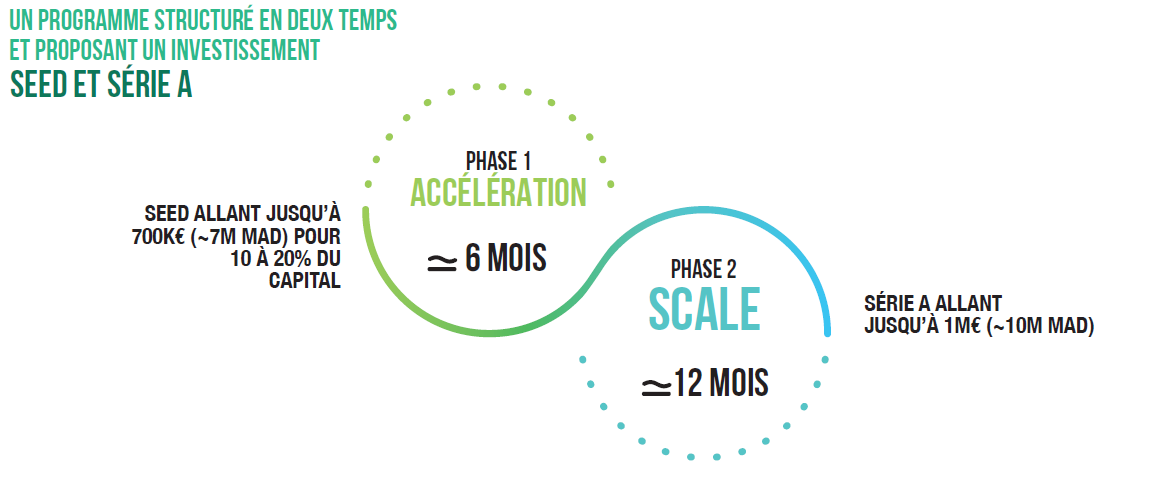

212Founders is an investment and support program for start-ups. It provides support to high-potential entrepreneurs during the seed or acceleration phases by providing them with the financing and support they need to grow and access the global market.

Launched in September 2019, the program is part of the implementation of the strategy of the Caisse de Dépôt et de Gestion (CDG), which places the development of the Moroccan entrepreneurial ecosystem as the core of its priorities.

The program is open to all entrepreneurs seeking to create world-class start-ups with links to Morocco and Africa.

-

Mission

Generation Entrepreneurs by CDG Invest is a support and financing program for young high growth potential companies in the industrial and service sectors. This program targets start-up or seed projects (less than 5 years in business) led by founders with proven experience in their fields and who demonstrate an ability to attract key partners for their projects or show other convincing competitive advantages. The proposed financing is provided in the form of equity and quasi-equity capital of up to MAD 20 million, in return for a minority position in the financing round.

-

Mission

The Third-Party Management (TPM) activity of CDG Invest is dedicated to private equity management on behalf of institutional investors in Morocco wishing to outsource this function. This offer includes several strategic missions, such as: (i) contribution to the definition of the strategic allocation, (ii) development of a customized investment strategy that meets the expectations of the client, particularly in terms of risk, (iii) origination and execution of transactions as per the investment strategy, (iv) monitoring of the portfolio, and (v) management of the administrative, accounting, financial, tax and legal aspects.

With the introduction of the GPCT activity, CDG Invest diversifies its offer to provide a comprehensive and customized solution for Moroccan institutional investors. This new offer represents an important step in our commitment to responding to the evolving needs of the financial market.

To date, an initial management mandate has been signed with RCAR to manage its private equity business.